We Are Recognised On

Get Quote Instantly

Documents Required for Proprietorship Registration

Documents will appear here once they are added.

For More Information

Advantages & Disadvantages of One Person Company (OPC)

Advantages

Disadvantages

Business Entity Comparison

| Parameters |

|---|

Frequently Asked Questions

Need Help?

If you have any questions or need assistance with proprietorship registration, feel free to contact us.

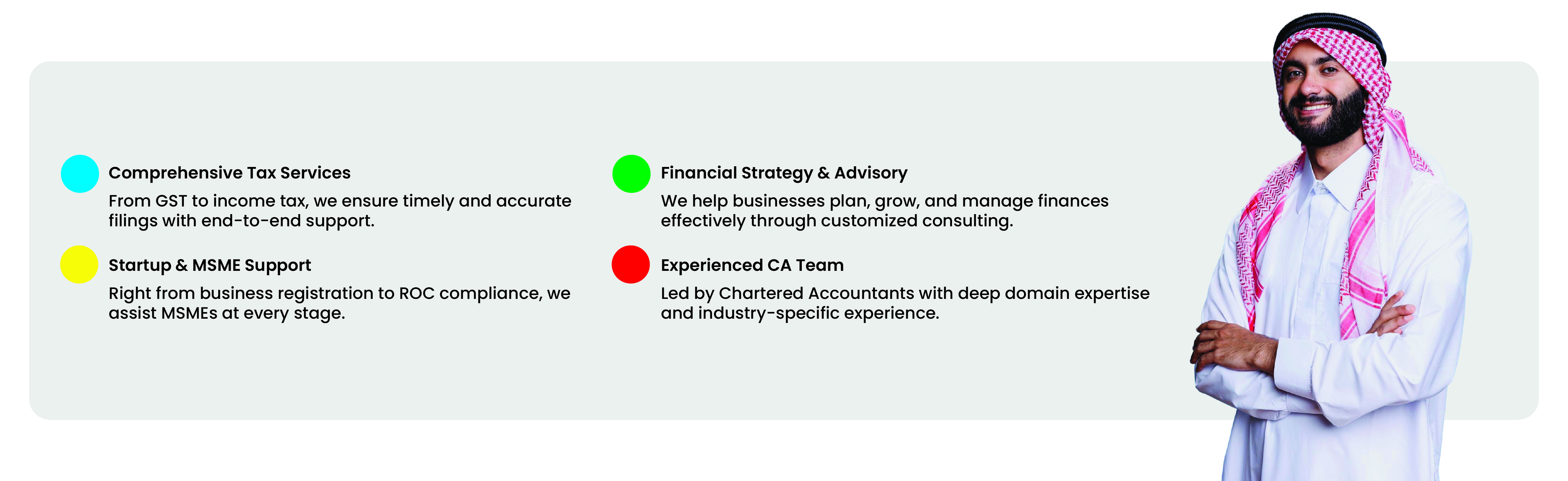

Contact UsWhy Choose ARK Advisor for Proprietorship Registration?

ARK Advisor is your trusted partner for all business registration needs. Our team of experienced Chartered Accountants provides comprehensive support, ensuring a smooth and hassle-free registration process.

What Our Clients Say

Discover what our satisfied clients have to say about their experience working with us

Popular Searches

No popular searches added yet.