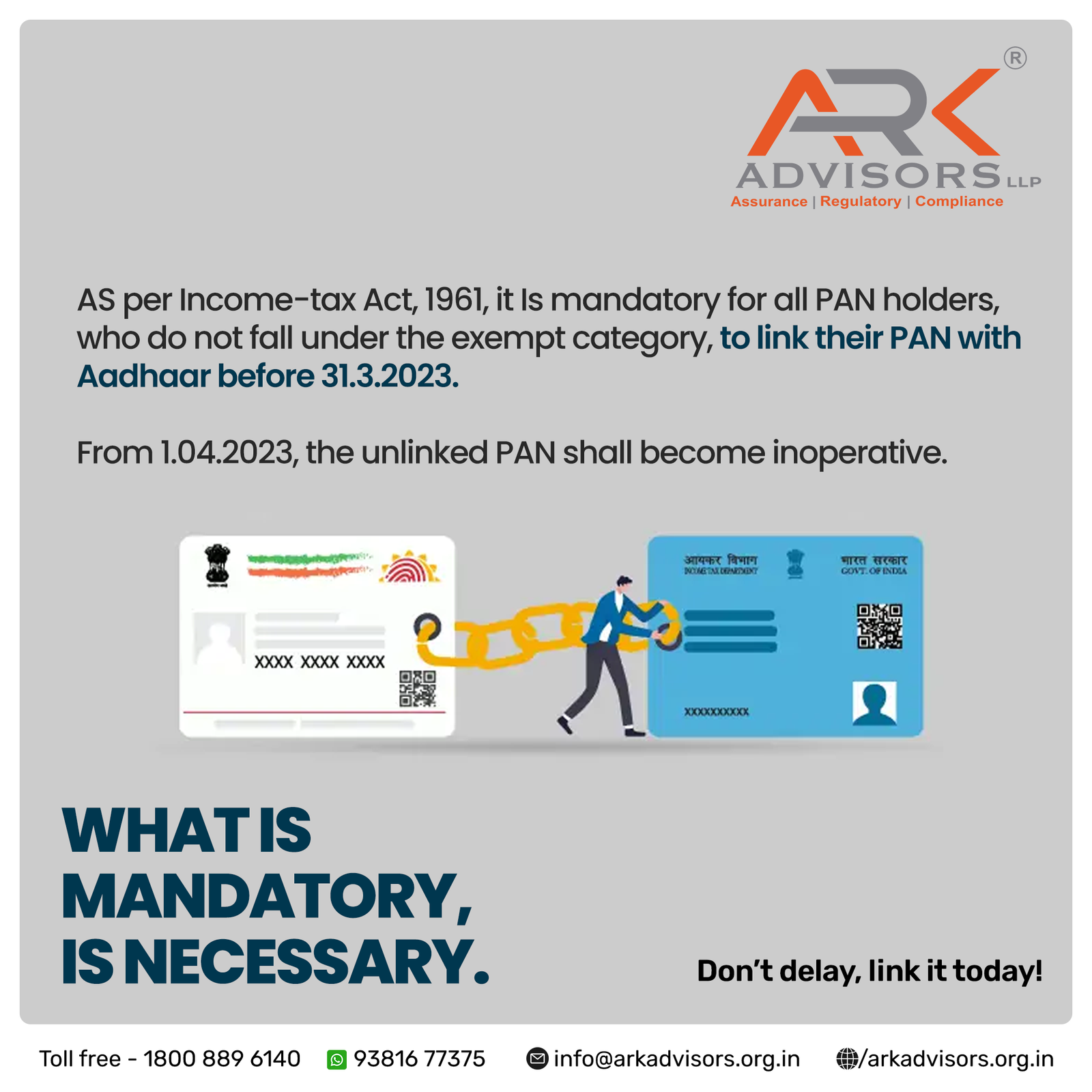

Linking of AADHAAR with PAN is MANDATORY. As per Section 139AA of the Income Tax Act 1961, every person eligible to obtain an Aadhaar and has PAN must link their Aadhaar with their PAN by 31st March 2023.

Here’s what happens if you don’t link your Aadhaar-PAN by 31st March 2023:

- You may be subject to a penalty of up to Rs. 10,000 according to the Income Tax Act.

- Your PAN will become inoperative until linked with Aadhaar

- TDS/ TCS deduction will attract a higher rate applicable to PAN not present.

- You will NOT be able to do many banking services such as:

- Book a Fixed Deposit above Rs. 50,000

- Deposit cash above Rs. 50,000.

- Get a new Debit/Credit Card

- Invest or redeem your Mutual Funds.

- Purchase any foreign currency beyond Rs. 50,000.

Benefits of Linking your PAN with Aadhaar

Some of the benefits of linking your PAN with Aadhaar are:

- It removes the possibility of an individual having more than one PAN Card.

- Linking of Aadhaar with PAN allows the Income Tax Department to meticulously detect any form of tax evasion

- The process of filing income returns become considerably easy as the individual is not required to provide any proof of him or her having filed their income tax returns.

- Linking of your Aadhaar with PAN will prevent the latter from getting cancelled.

FAQs on How to Link PAN Card with Aadhaar Card?

- If I don’t fall into the taxable bracket, do I still have to get an Aadhaar card or have it linked to my PAN?

Yes, it is advisable that you apply for an Aadhaar card and have it linked with your PAN. Aadhar is now necessary to avail most government benefits and so it is advisable to apply for it and also get it linked with PAN to ensure that your PAN is valid.

2. Do NRIs residing in India have to link their PAN as well?

The requirement to quote Aadhaar for filing income tax returns and for making an application for allotment of PAN with effect from July 1, 2017 does not apply to nonresident Indians [NRIs].

3. Is it mandatory to create an account with the department website?

No, it is not necessary to have an account with the department website. There is a direct link that is available which you can use to link your PAN and Aadhaar Card.

4. I used to live in India but settled abroad. I plan on returning to India. Do I need to apply for an Aadhaar Card or am I exempted from this rule?

If you plan on staying in the country for more than 6 months or 182 days, you will have to apply for an Aadhaar card when you reach India.

5. How long is the OTP sent by the Aadhaar database valid for?

The Aadhaar OTP is valid for a total of 15 minutes from the time it was generated.

6. How can I change the mobile number that is registered with Aadhaar?

You can get in touch with the UIDAI helpdesk by email at authsupport@uidai.gov.in or you can contact their toll-free number which is 1800-300-1947.

7. Can I de-link my Aadhaar number?

No. There is no option that is available to de-link your Aadhaar number once it has been updated on the e-filing page.

8. How do I make changes to an Aadhaar Number that I have filed?

You can get in touch with the UIDAI helpdesk by email at authsupport@uidai.gov.in or you can contact their toll-free number which is 1800-300-1947.

9. What should I do if my details as per my PAN card do not match with the ones mentioned on my Aadhaar card?

If the details on your PAN card such as spelling of name, date of birth or gender do not match the ones on your Aadhaar card, you will have to submit an application with valid proof and get the details corrected. After this, you may apply to link your Aadhaar with your PAN card.

10. Do I have to submit any documentary proof to link my PAN and Aadhaar card?

No, you are not required to submit any documents when linking your Aadhaar to your PAN card. You have to check if the PAN information mentioned on the website matches your Aadhaar card and then apply for them to be linked.

11. What are the details I have to check when linking my PAN with my Aadhaar card?

When linking your PAN with your Aadhaar card, you have to make sure that your name, date of birth and gender as displayed on the income tax website matches with the details on your Aadhaar card.

12. Is it necessary to link PAN with Aadhaar for an NRI?

No, it is not necessary for an NRI to link their PAN with Aadhaar. However, if an NRI has a PAN Card and an Aadhaar card, then it is recommended they get each other linked.

13. My banking transactions are worth more than Rs.50,000. Do I need to link my PAN with Aadhaar?

Yes, it will be mandatory for you to link your PAN with Aadhaar if your banking transactions are worth Rs.50,000 or more.

14. What is the last date to link my PAN with Aadhaar?

You must get your PAN linked with your Aadhaar by 31 March 2023.