Introduction:

Filing Goods and Services Tax (GST) returns on time is not just a legal requirement but also a crucial aspect of financial management for businesses. Unfortunately, missed deadlines can lead to penalties and other complications. In this comprehensive guide, we’ll delve deeper into the importance of timely GST filing, explore the consequences of missed deadlines, and provide actionable tips to ensure your business stays compliant and avoids unnecessary burdens.

Why Timely GST Filing Matters:

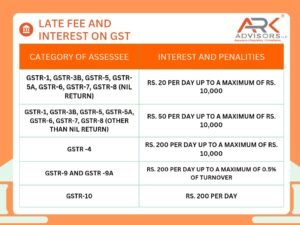

Late Filing Penalties: The most immediate consequence of missing the GST filing deadline is the imposition of late filing penalties. The penalty for late filing typically includes a fixed amount per day of delay along with interest on the outstanding tax amount. These penalties can accumulate over time, leading to significant financial implications for the business.

Impact on Input Tax Credit (ITC): Timely filing of GST returns is essential for claiming Input Tax Credit. Failure to file returns within the prescribed deadlines may result in the loss of ITC for the corresponding tax period. This can increase the tax liability for the business and affect its cash flow.

Legal Consequences: Persistent non-compliance with GST filing requirements can attract legal consequences. Tax authorities may initiate enforcement actions such as the issuance of notices, audits, and even prosecution in cases of deliberate evasion or fraud. These legal proceedings can be time-consuming and costly for businesses.

Suspension of GST Registration: In severe cases of non-compliance, tax authorities have the authority to suspend or cancel the GST registration of a business. This can have serious ramifications as it impedes the business’s ability to carry out taxable transactions legally. Additionally, the business may face challenges in obtaining loans, contracts, or government approvals without a valid GST registration.

Reputation Damage: Non-compliance with tax regulations can tarnish the reputation of a business. Customers, suppliers, and other stakeholders may perceive the business as unreliable or financially unstable, leading to erosion of trust and potential loss of business opportunities.

Tips for Ensuring Timely GST Filing:

Mark Important Dates: Keep a close eye on GST filing deadlines and mark them on your calendar well in advance. Setting reminders and alerts can help ensure that you don’t overlook these critical dates.

Maintain Accurate Records: Organize your financial records and transaction data systematically. By keeping accurate and up-to-date records, you can streamline the GST filing process and minimize the risk of errors or discrepancies.

Utilize Automation Tools: Invest in accounting software or GST filing platforms that automate the process. These tools can help simplify compliance tasks, reduce manual errors, and ensure timely submission of returns.

Seek Professional Assistance: If you’re unsure about GST compliance or facing complexities in filing returns, don’t hesitate to seek professional assistance. Tax experts or chartered accountants can provide valuable guidance and support to ensure compliance with GST regulations.

Plan Ahead for Peak Seasons: Anticipate high transaction volumes during peak business seasons and allocate sufficient resources to ensure timely filing.

Planning ahead can help you avoid last-minute rushes and ensure smooth compliance even during busy periods

Conclusion:

Timely GST filing is essential for businesses to maintain compliance with tax regulations and avoid penalties. By prioritizing timely compliance and implementing proactive measures, you can safeguard your business’s financial health and reputation. Remember, staying compliant with GST regulations is not just about fulfilling a legal obligation—it’s about protecting your business interests and ensuring smooth operations. So, don’t let missed deadlines weigh you down. Stay vigilant, stay compliant, and file on time.