Don’t File Your Income Tax Return

Introduction to Income Tax Filing in India

Income tax filing is a legal requirement mandated by the Government of India under the provisions of the Income Tax Act, 1961. It applies to individuals, companies, partnerships, and any other entities whose income exceeds the specified threshold limits set by the Income Tax Department. Filing your income tax return (ITR) is not just about fulfilling a legal obligation but also serves as a crucial financial responsibility and accountability measure.

What is an ITR and Why is it Necessary?

An ITR is a document that needs to be filed with the Income Tax Department of India as a declaration of an individual’s income and assets. This information is used to compute the income and the tax liability of an individual. In India, you must file an ITR under the following circumstances:

- If your total income exceeds the tax-free threshold based on your age.

- When seeking an income tax refund.

- If you’ve earned from or invested in foreign assets during the fiscal year.

- For companies or firms, regardless of profit or loss.

- If you’ve incurred losses in business/profession or under capital gains and wish to carry them forward to subsequent years.

- If you’ve deposited a cumulative amount of Rs 1 crore or more in one or more current accounts with a bank.

- Upon depositing over Rs 50 lakh in your savings bank accounts.

- If your foreign travel expenses exceed Rs 2 lakh.

- When yearly electricity expenditure surpasses Rs 1 lakh.

- If tax deducted at source (TDS) or tax collected at source (TCS) exceeds Rs 25,000 (or Rs 50,000 for senior citizens).

- When business turnover exceeds Rs 60 lakhs.

- If income from your profession exceeds Rs 10 lakhs.

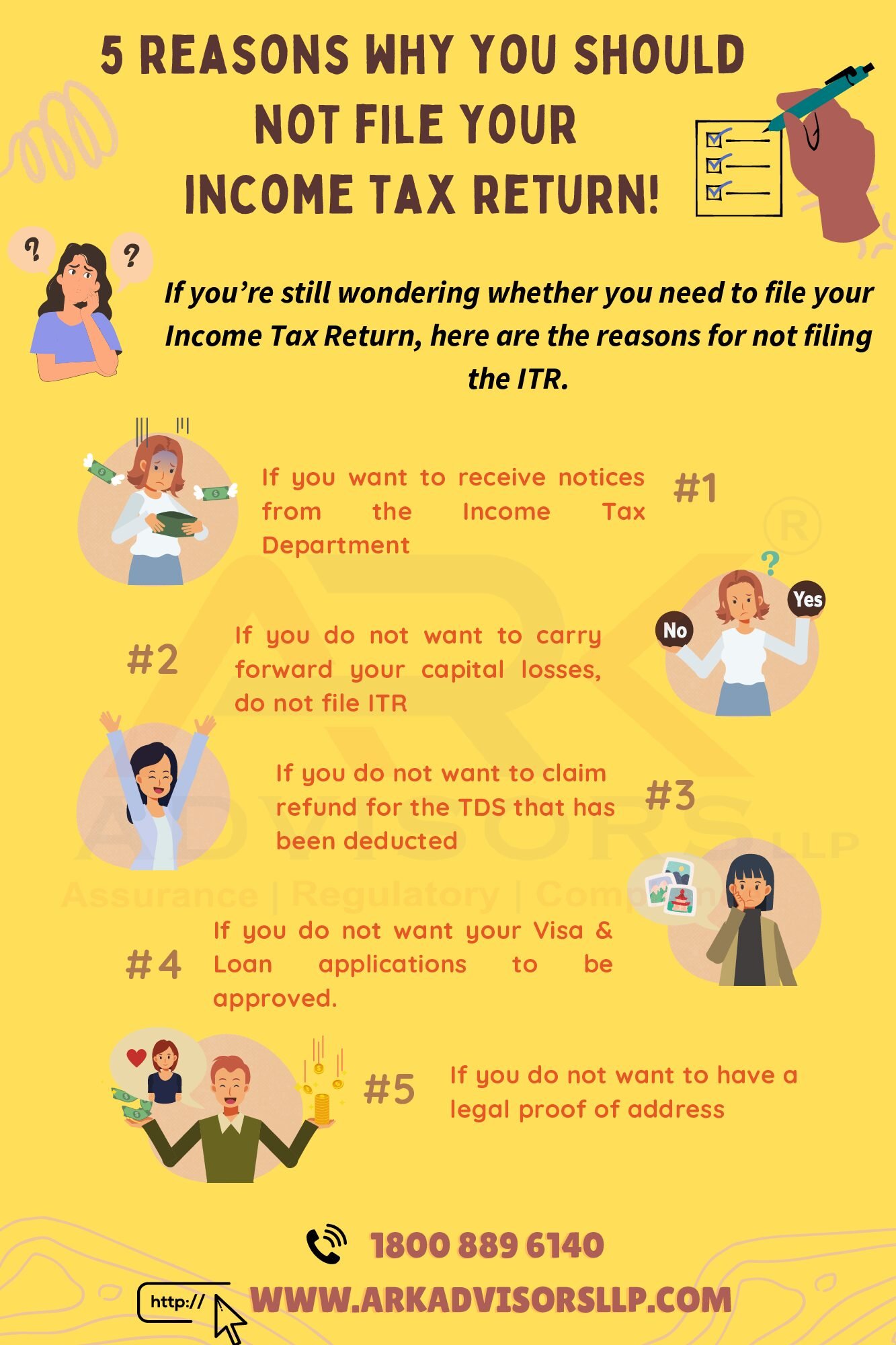

Things that come into your plate if you are not filing Income Tax Returns

When an individual fails to file their income tax return within the stipulated deadlines or chooses not to file altogether, several consequences may ensue, ranging from financial penalties to legal repercussions. Let’s explore these consequences in detail:

1 Penalties and Late Fees

One of the most immediate consequences of not filing your income tax return on time is the imposition of penalties and late fees. As per current provisions under Section 234F of the Income Tax Act:

- Delayed Filing: If the return is filed after the due date but on or before December 31 of the assessment year (AY), a penalty of ₹5,000 may be levied.

- Further Delay: Filing after December 31 but before March 31 of the AY may attract a penalty of ₹10,000.

- Income Below ₹5 lakh: If your total income is below ₹5 lakh, the maximum penalty is ₹1,000 for late filing.

These penalties are in addition to any interest that may be charged on unpaid taxes.

2 Interest on Outstanding Tax Liability

Apart from penalties, individuals who have unpaid taxes due after the deduction of TDS (Tax Deducted at Source) are liable to pay interest on the outstanding amount. The interest is calculated from the due date of filing (usually July 31 of the assessment year) until the date of payment.

3 Loss of Refunds

Failing to file your income tax return means forfeiting your right to claim any refunds due to you. Many taxpayers may be eligible for refunds if they have paid excess taxes or are entitled to deductions under various provisions of the Income Tax Act. However, without filing the return, you cannot claim these refunds, which could lead to financial loss.

4 No carry forward of losses

In a scenario in which you have incurred losses in your investment, you can use them to offset against next year’s income. As a result, it will reduce your tax liability in the next financial year. To carry forward and set-off losses, it is mandatory to declare them in your ITR before the deadline. If you file your tax return late, you will not be able to carry forward and set-off these losses against future profits. Although, you can carry forward the losses relating to house property.

5 Prosecution for failing to file your Income Tax Return

If you fail to furnish your ITR and your income tax liability is more than Rs. 25,000 you shall be punishable with rigorous imprisonment of minimum 6 months upto 7 years and with a fine. In any other case( i.e. tax liability is less than Rs.25,000) you shall be punishable with rigorous imprisonment of minimum 3 months upto 2 years and with a fine.

6 Loan and Visa Application

When applying for a loan or visa, lenders and embassies often require the last three years of Income Tax Returns (ITR) to verify your financial standing and eligibility. Submitting these documents demonstrates your financial history and strengthens your application. If you don’t file your ITR, these applications may get rejected.

7 Penalty under Section 271H

In addition to the late filing penalty under Section 234E, individuals who are unable to file TCS or TDS statements by the due date must pay a penalty ranging from Rs. 10,000 to Rs. 1,00,000. The penalty under Section 234E is a fine of Rs. 200 per day until the TCS or TDS is paid.

The Importance of Filing Income Tax Returns in India

Filing income tax returns (ITR) is not just a legal requirement but a fundamental responsibility for every taxpayer in India. The process of filing ITR allows individuals and entities to declare their income, claim deductions, and ensure compliance with the Income Tax Act, 1961. Beyond mere compliance, filing tax returns plays a pivotal role in financial transparency, accountability, and contributing to the nation’s economy. Here’s an in-depth exploration of why filing income tax returns is crucial and the consequences one may face for not adhering to these obligations.

1 Legal Obligation and Financial Responsibility

Under the Income Tax Act, anyone whose income exceeds the basic exemption limit must file their tax returns. This threshold varies depending on age, income sources, and other factors specified by the tax authorities. Filing ITR is not only a legal requirement but also a demonstration of one’s financial responsibility and contribution to the country’s revenue.

2 Claiming Refunds and Benefits

One of the primary benefits of filing tax returns is the opportunity to claim refunds for excess taxes paid during the financial year. Taxpayers can avail refunds if they have made investments or incurred expenses that qualify for deductions under various sections of the Income Tax Act. This ensures that individuals receive their rightful refunds and optimize their tax liability based on their financial activities.

3 Financial Documentation and Credibility

A filed tax return serves as crucial financial documentation for various purposes. It provides proof of income for individuals seeking loans, applying for visas, or engaging in other financial transactions. Financial institutions often require copies of tax returns to assess an individual’s creditworthiness and ability to manage financial commitments responsibly.

Steps to Non-Filing

If you find yourself in a situation where you have not filed your income tax returns, here are the steps you should take to rectify the situation:

- File Immediately: Begin by gathering all necessary financial documents and file your tax return as soon as possible. The sooner you file, the lower the penalties and interest you will incur.

- Calculate and Pay Taxes: Assess your tax liability for the year(s) in question, including any interest due on unpaid taxes, and make the necessary payment to the Income Tax Department.

- Use Online Platforms: Utilize the Income Tax Department’s e-filing portal or authorized tax filing websites to file your returns electronically. This makes the process faster and more convenient.

- Seek Professional Advice: If your financial situation is complex or if you are unsure about the process, consider consulting with a tax professional or a chartered accountant. They can provide personalized guidance and ensure compliance with tax laws.

- Stay Compliant: Moving forward, make it a habit to file your income tax returns on time every year. Set reminders, maintain organized financial records, and ensure all necessary forms and documents are prepared well in advance of the filing deadline.

What are the Due Dates for Filing Income Tax?

Take a look at the due dates for filing income tax return for the financial year 2023-2024.

| Category of Taxpayer | Due Date for Tax Filing |

| Individuals & HUFs (Audit cases) | 31st October |

| Individuals & HUFs (Non-audit cases) | 31st July |

| Firm, LLP, AOP, BOI, AJP, Local Authority, Co-operative society (Audit cases) | 31st October |

| LLP, BOI, Co-operative society, Local Authority, AOP, Firm, AJP (Non-audit cases) | 31st July |

| Companies | 31st October |

Conclusion

In summary, it is crucial for both individuals and companies alike to diligently file their income tax returns within the stipulated deadlines. By doing so, not only do you comply with legal requirements, but you also contribute to the smooth functioning of the economy. Timely filing ensures that you avoid penalties and legal complications that may arise from non-compliance. Therefore, I strongly urge everyone to take the necessary steps to file their Income Tax Returns (ITRs) promptly. Your cooperation in this matter not only benefits you personally but also helps maintain the integrity and efficiency of our tax system. Remember, filing your ITR is not just a legal obligation but a civic responsibility that ensures our collective prosperity.