All you need to know about Old Tax Regime and New Tax Regime

Introduction

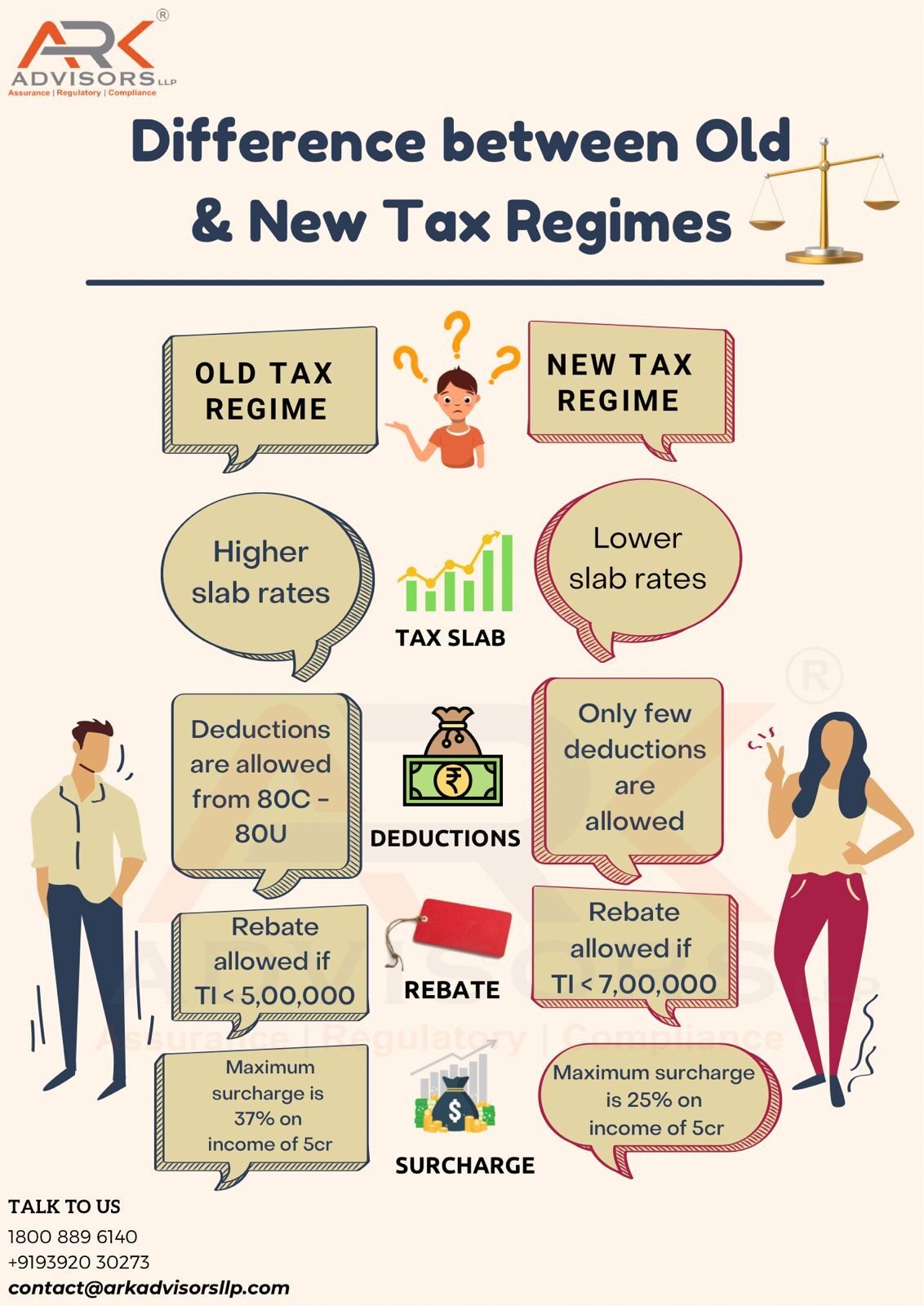

The Budget of 2023 introduced several incentives to make the new tax regime more appealing to taxpayers. These measures were designed to encourage adoption of the new regime over the old one. Despite the new regime becoming the default option, the old tax regime remains available.

In the Interim Budget 2024-2025, there were no changes made to direct taxes.

Now, let’s evaluate both regimes to determine the optimal choice for 2024.

What is Old Tax Regime?

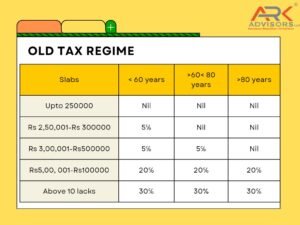

The Old Tax Regime was introduced way before the new tax regime. Taxpayers can claim various deductions and exemptions under different sections of the Income Tax Act. It has a higher tax rate compared to the new tax regime, but allows taxpayers to claim tax benefits on various investments and expenses.

Deductions Available Under the Old Tax Regime

1) Home Loan Interest and Principal Repayment (Sections 80C and 24(b)): Under Section 80C, repayment of the principal amount up to Rs 1.5 lakh per annum is eligible for deduction.

Section 24(b) allows deduction on interest paid up to Rs 2 lakh per annum on a home loan. If the property is rented out, the entire interest amount can be deducted from rental income, with a cap of Rs 2 lakh per annum.

2) Health Insurance Premiums (Section 80D): Deductions are available for premiums paid towards health insurance:

- 25,000 for self and family (Rs. 50,000 for senior citizens).

- 25,000 for parents (Rs. 50,000 for senior citizen parents).

- Additional Rs. 5,000 for preventive health check-ups.

- 50,000 for medical expenditure on uninsured senior citizen parents.

3) Investments in Government Schemes (Section 80C):

- Deductions of up to Rs 1.5 lakh are available for investments in:

- Senior Citizen Savings Scheme (SCSS)

- Sukanya Samriddhi Yojana (SSY)

- Public Provident Fund (PPF)

- National Pension Scheme (NPS)

4) Life Insurance Premiums (Section 80C and 10(10D)):

- Premiums paid up to Rs 1.5 lakh per annum for life insurance policies are eligible for deduction under Section 80C.

- Maturity proceeds or sum assured received on death are exempt under Section 10(10D), subject to conditions.

- Additional Investments under Section 80C:

- Investments such as 5-Year Bank Fixed Deposits, National Savings Certificate (NSC), and Equity Linked Savings Schemes (ELSS) are eligible for deductions up to Rs 1.5 lakh per annum.

5) Other Deductions:

- Interest on education loans (Section 80E).

- Donations to charitable institutions (Section 80G).

- Rent paid by non-salaried individuals (Section 80GG).

- Savings account interest (Section 80TTA) and interest income for senior citizens (Section 80TTB).

6) Employer Contributions and NPS (Section 80CCD):

Employer contributions to NPS (Section 80CCD(2)) and individual contributions (Section 80CCD(1B)) are eligible for deductions.

These deductions help taxpayers reduce their taxable income significantly under the old tax regime, providing various avenues to save on income tax through investments, insurance, and expenditures on specified items.

What is New Tax Regime?

The New Tax Regime in India, introduced in Budget 2020, offers taxpayers an alternative to the existing tax structure. Here are the key features and aspects of the New Tax Regime:

Key Features of the New Tax Regime:

- Optional Regime: The New Tax Regime is optional for individual taxpayers. It provides an alternative tax structure alongside the existing Old Tax Regime, allowing taxpayers to choose the regime that best suits their financial situation each financial year.

- Lower Tax Rates: The New Tax Regime offers lower tax rates compared to the Old Tax Regime. The tax rates under the New Regime are structured to reduce the tax burden on individuals across different income slabs.

- Simplified Tax Structure: Under the New Tax Regime, the tax structure is simplified by reducing the number of tax slabs and eliminating most deductions and exemptions. This aims to streamline tax compliance and make tax calculations simpler for taxpayers.

- No Deductions and Exemptions: One of the significant changes in the New Tax Regime is the removal of various deductions and exemptions available under the Old Tax Regime. Taxpayers opting for the New Regime do not benefit from deductions such as Section 80C (for investments in PPF, NSC, etc.), Section 80D (health insurance premiums), HRA, LTA, and others.

- Standard Deduction and Other Benefits: Despite removing many deductions, the New Tax Regime retains certain benefits such as standard deduction for salaried individuals, tax benefits on NPS contributions under Section 80CCD(1B), and deductions for specified allowances for certain categories of taxpayers.

- Applicability: The New Tax Regime is applicable to resident individuals and Hindu Undivided Families (HUFs) who do not have income from business or profession.

Detailed Tax Deductions and Exemptions under the New Tax Regime

1) Salary income: The standard deduction of ₹50,000, which was only available under the old regime, has now been extended to the new tax regime as well. This, along with the rebate, makes ₹7.5 lakhs as your tax-free income under the new regime.

2) Employer Contribution to NPS (Section 80CCD(2)):

- Deduction available for employer’s contribution to NPS.

- Applicable to salaried individuals; not available to self-employed.

- Employer contribution can match or exceed employee contribution.

- Central government employees can claim up to 14% of salary (Basic+DA); non-government employees limited to 10%.

- Overall threshold of Rs 750,000 for contributions to PF, NPS, and Superannuation.

3) Agniveer Corpus Fund (Section 80CCH(2)):

- Contributions by applicants and central government to Agniveer Corpus Fund eligible for deduction.

- Also applies to incomes received under the Agnipath Scheme.

- Soldiers enrolled receive benefits including ration, risk compensation, travel allowances, and disability compensation.

- Deduction available under both old and new tax regimes.

4) Family Pension Income (Section 57(iia)):

- Family pension paid to deceased employee’s family is eligible for deduction.

- Deduction limited to ⅓ of received income or Rs 15,000, whichever is lower.

5)Interest on Home Loan on Let-out Property (Section 24):

- Interest on home loan for let-out property fully deductible under Section 24.

- No upper limit on deduction, unlike for self-occupied property under the new tax regime.

6) Transport Allowance and Conveyance Allowance:

- Transport allowance reimburses commuting expenses between residence and workplace.

- Exemption up to Rs. 3,200 per month for physically challenged employees.

- Conveyance allowance exempt to the extent of actual expenditure incurred for official duties.

7) Exemptions under Section 10 for the New Tax Regime:

- Certain exemptions now allowed under the new tax regime:

- Voluntary Retirement Scheme (VRS): Exempt up to Rs. 5 lakh.

- Gratuity (Section 10(10)): Fully exempt for government employees; private employees based on Payment of Gratuity Act coverage.

- Leave Encashment: Exemption up to Rs. 25 lakhs; excess amount taxable.

These deductions and exemptions provide opportunities for taxpayers to reduce their taxable income significantly under the old tax regime, covering a wide range of contributions, allowances, and specific income exemptions.

What Comparison Deductions and Exemptions are Allowed Under the Old Tax Regime vs New Tax Regime

| Particulars | Old Tax Regime | New Tax Regime |

| Income level for rebate eligibility | 5 Lakhs | 7 Lakhs |

| Standard Deduction | 50000 | 50000 |

| Effective Tax-Free Salary income | 5.5 lakhs | 7.5 lakhs |

| Rebate u/s 87A | 12500 | 25000 |

| HRA Exemption | Yes | No |

| Leave Travel Allowance (LTA) | Yes | No |

| Other allowances including food allowance of Rs 50/meal subject to 2 meals a day

|

Yes | No |

| Standard Deduction (Rs 50,000) | Yes | Yes |

| Entertainment Allowance and Professional Tax | Yes | No |

| Perquisites for official purposes | Yes | Yes |

| Interest on Home Loan u/s 24b on: Self-occupied or vacant property | Yes | No |

| Interest on Home Loan u/s 24b on: Let-out property | Yes | Yes |

| Deduction u/s 80C (EPF | LIC | ELSS | PPF | FD | Children’s tuition fee etc) | Yes | No |

|

Employee’s (own) contribution to NPS |

Yes | No |

|

Employer’s contribution to NPS |

Yes | Yes |

| Medical insurance premium – 80D | Yes | No |

| Disabled Individual – 80U | Yes | No |

| Interest on education loan – 80E | Yes | No |

| Interest on Electric vehicle loan – 80EEB | Yes | No |

| Donation to Political party/trust etc – 80G | Yes | No |

| Savings Bank Interest u/s 80TTA and 80TTB | Yes | No |

| Other Chapter VI-A deductions | Yes | No |

| All contributions to Agniveer Corpus Fund – 80CCH | Yes | Yes |

| Deduction on Family Pension Income | Yes | Yes |

| Gifts upto Rs 50,000 | Yes | Yes |

| Exemption on voluntary retirement 10(10C) | Yes | Yes |

| Daily Allowance | Yes | Yes |

| Conveyance Allowance | Yes | Yes |

| Transport Allowance for a specially-abled person | Yes | Yes |

Conclusion

Many individuals often find themselves questioning the disparities between the old and new tax regimes. The new income tax regime is designed to accommodate those who have more personal commitments such as repayment of personal/vehicle loans, medical treatment of parents or dependents, or wish to avoid the burden of extensive tax preparation or have minimal tax deductions due to their ineligibility for section 10 exemptions, standard deductions, tax on employment, employer contribution to pension scheme etc., Conversely, the old tax regime can yield more tax savings for senior citizens, who derive a substantial portion of their income from interest, can benefit from Section 80TTB, which allows them to claim Rs.50,000 as interest income deduction and feel more secure under the old tax regime.

Both the old and new tax regimes possess advantages and disadvantages. The previous tax structure encourages taxpayers to cultivate a habit of saving, while the new tax structure favours employees with lower earnings and investments, resulting in fewer deductions and exemptions. The new tax system is considered safer and simpler, involving fewer records and reducing the potential for tax evasion fraud. However, due to the unique nature of individual deductions and exemptions, a thorough comparison of the two regimes is necessary to determine the best fit for each person.