Missed filing ITR? Worry not, as December 31 is the last day to file belated Income Tax Returns :

As the saying goes, “Better late than never,” but when it comes to filing your Income Tax return (ITR), failing to meet the deadline can have serious consequences.

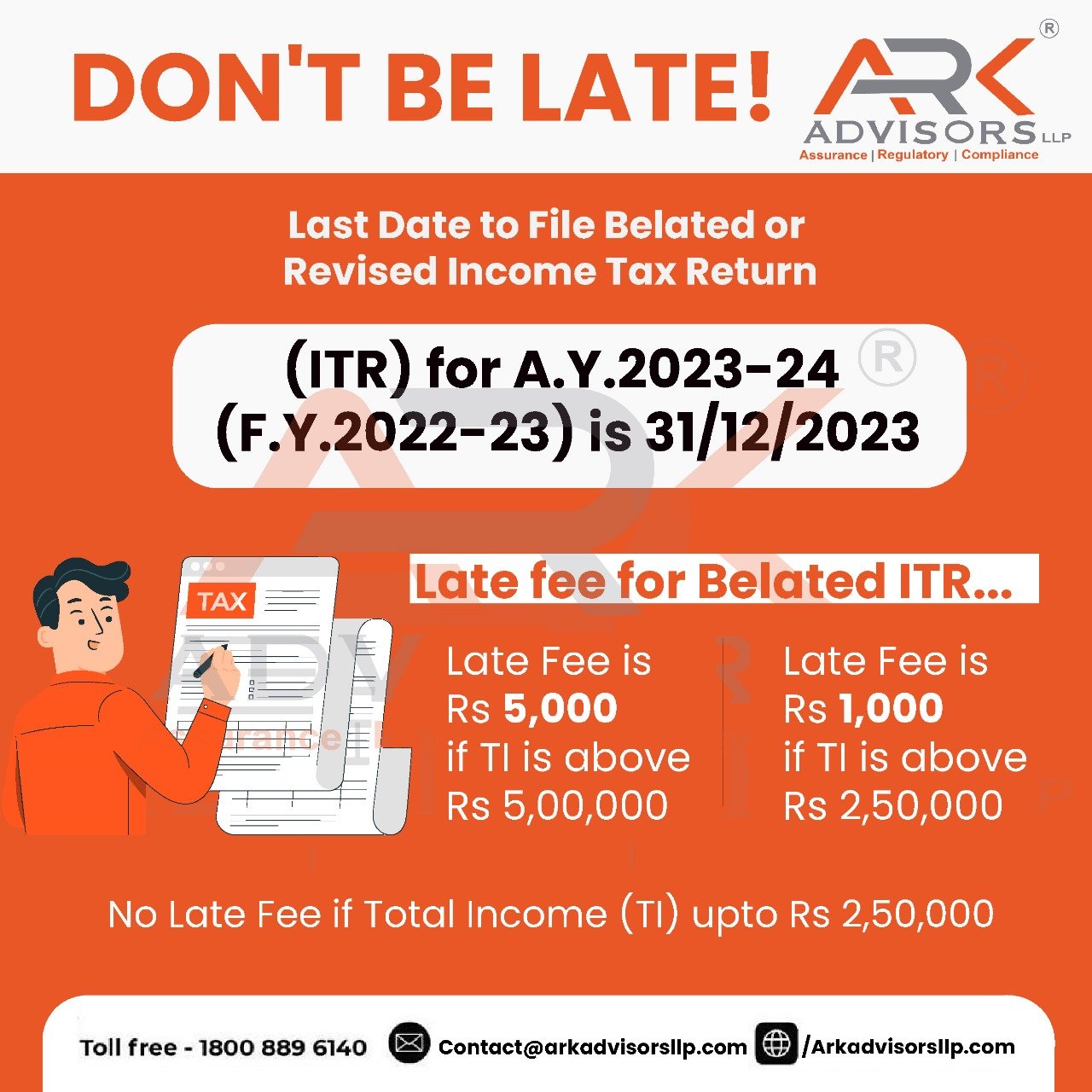

Taxpayers who have yet to file their Income Tax Returns for the Financial Year 2022-2023 should take immediate action. The deadline of December 31, 2023, represents the final chance for individuals to fulfil this obligation. However, failure to meet this deadline comes with penalties and interest for late filing. Therefore, it is vital to understand the consequences and the significance of timely filing.

Late filing fee and interest charges

The initial deadline for submitting income tax returns for the Fiscal Year 2022-2023, also known as the Assessment Year 2023-2024, expired on July 31, 2023. Individuals who were unable to meet this deadline now have until December 31 to file their ITRs. It is important to realize that the December 31 deadline applies to all taxpayers, including individuals, corporations, those undergoing audits, and those not undergoing audits.

In accordance with Section 234F of the Income Tax Act, individuals who fail to file their returns before the due date will be subject to a late filing fee. For those who missed the deadline, the penalty is ₹5,000. However, taxpayers whose total income remains below ₹5 lakh will only have to pay a reduced penalty of ₹1,000.

In addition, if a taxpayer files their return late, they will be charged interest under section 234A. This interest is calculated at a rate of 1 percent for every month, or part of a month, on the amount of unpaid tax.

Consequences of Not Filing Income Tax

Failure to file ITRs at all can have significant consequences. Taxpayers will not be able to carry forward losses from the current assessment year, and penalties may be imposed for non-compliance. Penalties can range from 50 percent to 200 percent of the assessed tax, depending on the extent of non-compliance.

- For salaried person

If an ITR is filed after 31st July of Assessment year, the late fee is ₹ 5,000. Additionally, for people having a total yearly income below ₹ 5 lakhs, the maximum penalty is up to ₹1,000.

- For self-employed

The rule for self-employed people is the same as above. ₹10,000 is paid as a penalty in case of general late payment, and if you have filed the ITR after 31st August but before 31st December, you have to pay a fine of ₹5000. And, in the case your income does not exceed ₹5 lakhs, you need to pay ₹1000.

- For companies

The rule for late payment of ITR is the same for companies as well. The penalty will be ₹10,000, but if the income is less than ₹5 lakhs, you need to pay a fine of ₹1000.

- For senior citizens

Senior citizens will also need to pay a late fine of ₹10,000 if they fail to declare their ITR by the due date, and if their income is less than ₹5 lakhs, a fine of ₹1000 will be imposed.

Always check what happens if ITR is not filed if you fail to service the due amount within its deadline.

Are there Any Charges and Penalties if I Missed the Date?

It may be the case that if ITR is not filed within the due date, taxpayers can still file the returns later, after clearing the requisite fines. This filing is called belated returns; however, it is strongly not recommended to miss the ITR deadline of 31st July 2023 as you’ll have to face the following consequences:

- Late Fee : You will have to pay a late fee of ₹5,000 under Section 234F in case you miss the ITR deadline of 31st July 2023. However, if your total income is less than ₹5 lakhs, the fine is reduced to ₹1,000.

- Imprisonment : If you have willfully failed to file the ITR for that stipulated financial year, the income tax officer can file charges against you, leading to imprisonment for a term of 3 months to 2 years, along with a fine. If you owe a large amount of tax to the income tax department, the imprisonment term may extend to 7 years.

- Extra Interest : Interest under Section 234A @ 1% per month or part month on the unpaid tax amount will be levied if you fail to file your return before the due date.

- Loss Adjustment : In case you have incurred losses from the stock market, mutual funds, or any of your businesses, then you can carry them forward and declare them with your next financial year’s income to significantly lower your tax liability.

However, in case you miss the ITR deadline, this facility is not available to you.

- Belated Return : ITR filed after the stipulated due date is called the Belated Return. Under this, you will still have to pay the late fee and interest, as per the rates mentioned above, and also cannot carry forward the losses in the next financial year.

As per the Income Tax Department, the specified due date of filing the belated return is 31st December of the assessment year (unless extended by the government). For FY 2022-23, the deadline for belated return is 31st December 2023.

What if Income Tax is not Filed for Previous Years?

If ITR is not filed for previous years, then you can file it later online by applying for Condonation of Delay at the online portal of the IT Department. However, you can file ITR only for the two years preceding the current financial year. For example, if you want to file your ITR for FY 2021-22 and FY 2022-23, then you must do so by the end of FY 2023-24, i.e., by 31st March 2024.

However, you have to pay a fine of ₹5000 for missing the deadline of 31 July of current financial year. If you have a genuine reason for not filing and the Income Tax officer is satisfied with your explanation, you may not have to pay any fine.

Are there any charges and penalties?

For the assessment year 2023-24, the taxpayer is liable to pay ₹ 5000 if he/she declares ITR after the deadline but on or before 31st December.

In conclusion, if an Income Tax return is not filed, citizens and businesses are likely to pay a penalty. To avoid this, all individuals should speedily clear their income tax dues. Non-filing of income tax returns is a serious offence, and people should be aware of the indignity of the offence.

Advantages of filing your Income Tax Return?

Do you know, there are a good number of reasons to file your ITR. Are you wondering whether you should file your income tax return or not?

Or you read it somewhere that if your income is below the basic exemption limit, then you might as well skip filing your income tax return?

However, before you make up your mind on not filing your ITR, it’s worth considering the advantages of filing your income tax return, even if it’s not mandatory.

- Easy Loan Approval

Filing your ITR can be beneficial when applying for various loans such as vehicle loans (2-wheelers or 4-wheelers) or home loans. Major banks often require a copy of your tax returns as proof of your income statement. This is a mandatory document for loan approval.

- Claim Tax Refund

There may be instances where tax has been deducted (TDS) from your income, even if your total taxable income is below the basic exemption limit, or you have no tax liability for that year. In such cases, you must file an Income Tax Return to claim a refund of the TDS.

- Income & Address Proof

Your Income Tax Return can serve as proof of your income and address.

- Quick Visa Processing

When applying for a visa, most embassies and consultants require copies of your tax returns from the past couple of years. These documents are among the mandatory requirements. Therefore, it is advisable to file your ITR in a timely manner.

- Carry Forward Your Losses

By filing your return within the original due date, you can carry forward losses to subsequent years. These losses can be offset against the income of future years, thereby reducing your tax liability. Without filing an income tax return, this benefit would not be possible.

- Avoid Penalty

If you are required to file your tax returns according to the income tax act but fail to do so, the tax officer has the right to impose a penalty of up to Rs. 5,000.

- For Buying Term Insurance

To approve term insurance plans, insurance providers often require applicants to submit their Income Tax Return (ITR) records as proof of their annual income. The coverage amount is determined based on the individual’s earnings, and presenting the ITR helps insurance providers assess a person’s higher income level.

- Claim Refund of Excess Tax Payments

Even if your income is below the taxable threshold, taxes may still be deducted from sources such as your salary, fixed deposit (FD), or other income.

For example, if your total income is less than Rs. 2.5 lakhs, but you received Rs. 1 lakh from an FD, the bank is required to deduct 10% tax on this amount. In such cases, individuals can claim a refund for the tax deducted by filing an Income Tax Return (ITR).

In simple terms, filing a tax return allows individuals to recover any tax deducted at the source.

Bottom Line

The filing of ITR is an important obligation cast by the law on the taxpayers. It is important for the taxpayers to report their income and assets in ITR and pay applicable taxes within the stipulated timelines.

Over the last few years, there has been a substantial increase in the number of tax return filings. The government has also introduced several measures to encourage more filing of ITRs by the eligible taxpayers.

These measures include revamping the income-tax portal, pre-filled forms having auto-populated data from permanent account number (PAN), withholding tax returns, other reporting by financial institutions, etc. It has also helped the government in tracking tax defaulters.

While the filing of ITR has many financial and non-financial benefits in terms of relative ease of access to loans, avoidance of interest and penalties, the claim of tax refund, hassle-free visa processing, etc., it is also the social responsibility of every tax payer.

It is pertinent to note that with various databases getting linked like Income Tax department, GST authorities, SEBI, and tax authorities receiving information from various sources like overseas tax jurisdictions under information exchange agreements etc, coupled with the increased automation and digitization, most of the information is or will be readily available with the tax authorities. Therefore, there is no escaping for the tax man.